The following article by James Dennin was posted on the mic.com website November 16, 2017:

The House of Representatives passed its version of a tax overhaul on Thursday by a 227-205 vote. The passage represents a major hurdle cleared for the GOP, but it’s still not clear whether the bill can survive a vote in the Senate — expected soon, following approval by the Senate Finance Committee Thursday night — and become law.

The House of Representatives passed its version of a tax overhaul on Thursday by a 227-205 vote. The passage represents a major hurdle cleared for the GOP, but it’s still not clear whether the bill can survive a vote in the Senate — expected soon, following approval by the Senate Finance Committee Thursday night — and become law.

The bill, rolled out two weeks ago, has been criticized for purporting to help average Americans, while eliminating many middle-class benefits. Indeed, the biggest beneficiaries of reform seem instead to be corporations, said Jacob Leibenluft, a senior adviser for the Center for Budget and Policy Priorities.

Meanwhile, scores of the bill from the bipartisan Joint Committee on Taxationand Tax Policy Center suggest many middle-class families could actually see taxes go up. Some 36 million households making less than $200,000 per year would see a tax increase of $100 or more by 2026, according to JCT data analyzed by Bobby Kogan, an aide for the Senate Budget Committee. And according to the Tax Policy Center, a full 30% of middle-income households would see their bill go up by an average of $1,230 by 2027.

“Many will end up paying more, and many of the rest are simply left out,” Liebenluft said.

How could the bill’s provisions affect you? Here are 5 big takeaways to know.

1. Some taxpayers win, while others lose

The plan doubles the standard deduction — but eliminates the personal exemption — and collapses the number of brackets from seven to four: You might end up in a higher or lower tax bracket than you are currently.

If you’re a married joint filer with income less than $18,000, for example, you would go from the 10% tax bracket to a new, higher 12% bracket. But if you’re a single filer earning $240,000, you’d see your bracket drop from 39.6% to 35%.

The bill repeals many taxes wealthier taxpayers don’t like, including the estate tax and the alternative minimum tax, a rate that ensures high-earners can’t skirt taxes by applying too many deductions — but that upper middle-class taxpayers complain has grown too harsh because of “bracket creep.”

In addition, the plan repeals many popular deductions, including those for state and local income taxes, moving expenses, student loan interest and deductions for people with extremely high medical expenses. The House bill would also eliminate the break that teachers get for buying school supplies — while the Senate version of the bill would actually double that deduction. Deductions on charitable contributions and mortgage interest would stay, but with new caps.

Finally, both House and Senate bills lower the corporate tax rate from 35% to 20%.

2. If you get a tax cut, it might be temporary

In the short term, the majority of filers will see a tax break largely through the doubling of the standard deduction. A family of four making the median household income of $59,000 per year, for example, would see their bill drop by about $1,200 in 2018, according to a tax calculator from Cleveland.com.

But some taxpayers could actually pay more: “At least 7% of taxpayers would pay higher taxes under the proposal in 2018, and at least 24% of taxpayers would pay more in 2027,” according to think tank Tax Policy Center. Yet “the largest cuts, in dollars and as a percentage of after-tax income, would accrue to higher-income households.”

Additionally, as many critics like Leibenluft and New York University School of Law’s David Kamin have pointed out, the benefits of this middle-class tax break end after a few years. For one, that $1,200 tax cut includes child tax credits that phase out by the year 2023. The House bill also adds revenue by using a new, slower measure of inflation.

The Senate version of the bill will similarly raise taxes on pretty much all taxpayers starting at the end of 2025, said Seth Hanlon, a fellow at the liberal Center for American Progress and former special adviser to President Barack Obama. Yet the plan would make tax cuts for corporations permanent.

“Just one tax provision affecting families stays in place after 2025 and that’s the one that slows the inflation adjustments in the tax codes,” Hanlon said. “It’s a hidden, sneaky tax increase on every family.”

Another example of tax benefits tilted away from workers and toward corporations? The House bill repeals the ability of union members to deduct their dues — but not the ability of firms to deduct legal expenses for negotiating with unions.

3. Taxes might be simpler — but for the wrong reasons

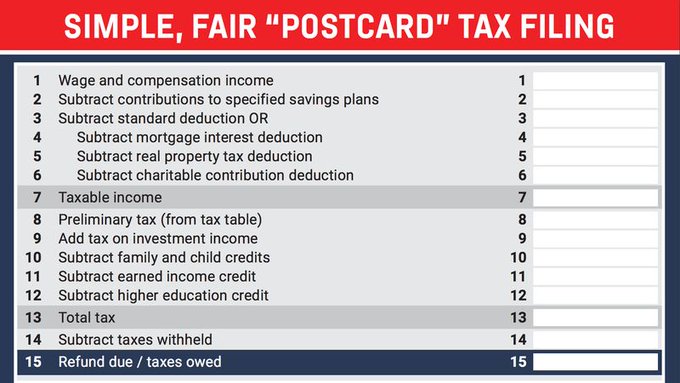

One of the most-touted benefits of the bill is the fact that it would literally make filing taxes easier. Doubling the standard deduction achieves this by reducing the number of households for whom it would be worthwhile to itemize their bill. Congressional Republicans have also tried to sell the bill by emphasizing a “postcard-sized” form.

There’s just one problem. For those taxpayers who end up with a simpler process, there’s a decent chance it is because they will have lost itemized and other deductions. And for small businesses, tax filing might actually get more complicated.

4. Your health care costs could rise

The tax bill could affect your health care spending in a few ways. For one, the House version does away with the medical expense deduction, which allows you to deduct medical expenses that exceed 10% of your adjusted gross income. That benefit is often used in situations that require some form of long-term care, parents of children with disabilities and fertility treatments.

But a bigger concern for people with high health expenses may lurk in the Senate’s version of the bill, said Amanda Starc, a health care economist and professor at Northwestern University’s Kellogg School of Management. In a post at Econofact, Starc writes that by repealing the Affordable Care Act’s individual mandate, the Senate plan could effectively increase insurance premiums by 20%.

“To the extent that this affects average American voters, we want to think about how it’s going to affect their household as a whole and not just the federal budget,” Starc said by phone. “I think we want to look at this holistically. There are subsidies available up to 400% of the poverty level. It’s not correct that it’s a double whammy for people who can’t afford insurance.”

A final reason why the tax debate is also a health care debate?

The budget adds considerably to the national debt, said Kimberly Burham of the Penn Wharton Budget Model, which estimates the Senate bill will lower tax revenues by between $1.4 trillion and $1.7 trillion over the next 10 years. It’s enough of a dent in the budget that Burham said the net effect on economic growth will start wearing off by 2040.

All those budget deficits are likely to lead to big spending cuts that could hurt low-income Americans: The Congressional Budget Office projects that automatic spending cuts would have to kick as soon as 2018, resulting in a $25 billion cut to Medicare.

5. Students and university workers could pay more under the tax plan

One constituency the bill could hit particularly hard? Students. One of the ways the plan raises revenue is by treating tuition waivers — when a student receives a break on their tuition as part of their compensation for teaching and research — as taxable income. This would definitely hit graduate students but would also hurt college employees (like janitors and receptionists) who sometimes take jobs at universities explicitly because they can earn free tuition, said the Center For American Progress’s Hanlon.

“A janitor or a receptionist at a university … taking classes to improve their skills and get a higher paying job, they’re going to be hit hard,” Hanlon said. “It just shows you that this is the opposite of what they’re saying, it’s not about working people it’s not about getting ahead, it’s about keeping people down to pay for corporate tax cut.”

The tax hikes on students could be substantial. Early analyses from graduate students at Ohio State University and the University of California, Berkeleyestimate that the tax burdens of these students would go up by between $3,000 and $4,000. The Berkeley study also estimates that graduate students at private universities, who pay much higher tuition, could see their tax bill rise by as much as 240%.

“It’s more than doubling the amount of income that’s considered taxable for most Ph.D. students, unless you’re married to someone with a better-paying job,” said Jon Green, who is pursuing a doctorate’s degree in political science at Ohio State. “If the schools don’t do something to offset the tax changes, many people will drop out.”

“It’s really a kind of existential threat to the model of how graduate students afford their education,” Hanlon said.

Will tax reform actually pass?

It’s not yet clear if the House bill can become law. For one, the vote in the Senate is expected to be a tighter one — several GOP senators retiring this year are not beholden to President Donald Trump, including Arizona Sens. Jeff Flake and John McCain.

Wisconsin Sen. Ron Johnson has also withdrawn his support for the bill, and Maine Sen. Susan Collins and Alaska Sen. Lisa Murkowski are also expected to push back against the bill’s plan to repeal the individual mandate.

“The reason [Republicans] are trying so desperately to get something through is to say that they got something through, which they need to fight in the midterms,” said Monica Prasad, a Northwestern professor of sociology. “If I were betting on its passage, I’d say no, there’s so many things here that so many Republicans don’t like … but I’m not going to bet.”

Even if bills pass in both chambers, the House and Senate will have to hash out the differences in a reconciliation process. You can read our full analysis of the House and Senate tax bills here.

Nov. 16, 2017, 11:30 p.m. Eastern: This story has been updated.

View the post here.